How Does The Fed Buying Bonds Affect Interest Rates . omo also affects interest rates because prices are pushed higher and interest rates decrease when the fed buys bonds. A bond's yield is based on the bond's coupon payments divided by. the federal reserve’s decision on september 18th to lower interest rates by half a percentage point, to between 4.75% and 5%, is. Adjust bond allocations based on duration. bond yields are significantly affected by monetary policy—specifically, the course of interest rates. Fed sees faster time frame for rate hikes as inflation rises It pushes prices down and rates. the federal reserve's open market operations—the purchase or sale of government bonds and other securities—can. Will that help deflate the inflation balloon? the big story in bonds has been how inflation and higher interest rates clobbered their performance by knocking.

from saylordotorg.github.io

the federal reserve’s decision on september 18th to lower interest rates by half a percentage point, to between 4.75% and 5%, is. omo also affects interest rates because prices are pushed higher and interest rates decrease when the fed buys bonds. the federal reserve's open market operations—the purchase or sale of government bonds and other securities—can. Will that help deflate the inflation balloon? Fed sees faster time frame for rate hikes as inflation rises A bond's yield is based on the bond's coupon payments divided by. bond yields are significantly affected by monetary policy—specifically, the course of interest rates. It pushes prices down and rates. Adjust bond allocations based on duration. the big story in bonds has been how inflation and higher interest rates clobbered their performance by knocking.

The Tools of the Fed

How Does The Fed Buying Bonds Affect Interest Rates A bond's yield is based on the bond's coupon payments divided by. bond yields are significantly affected by monetary policy—specifically, the course of interest rates. It pushes prices down and rates. the big story in bonds has been how inflation and higher interest rates clobbered their performance by knocking. the federal reserve’s decision on september 18th to lower interest rates by half a percentage point, to between 4.75% and 5%, is. Will that help deflate the inflation balloon? the federal reserve's open market operations—the purchase or sale of government bonds and other securities—can. omo also affects interest rates because prices are pushed higher and interest rates decrease when the fed buys bonds. Fed sees faster time frame for rate hikes as inflation rises Adjust bond allocations based on duration. A bond's yield is based on the bond's coupon payments divided by.

From sambsamantha.pages.dev

Best Auto Refinance Rates 2024 In India Miran Tammara How Does The Fed Buying Bonds Affect Interest Rates the federal reserve's open market operations—the purchase or sale of government bonds and other securities—can. bond yields are significantly affected by monetary policy—specifically, the course of interest rates. the federal reserve’s decision on september 18th to lower interest rates by half a percentage point, to between 4.75% and 5%, is. Fed sees faster time frame for rate. How Does The Fed Buying Bonds Affect Interest Rates.

From equitablegrowth.org

The Fed is aggressively but perhaps deliberately playing catchup on How Does The Fed Buying Bonds Affect Interest Rates It pushes prices down and rates. Will that help deflate the inflation balloon? the federal reserve’s decision on september 18th to lower interest rates by half a percentage point, to between 4.75% and 5%, is. A bond's yield is based on the bond's coupon payments divided by. bond yields are significantly affected by monetary policy—specifically, the course of. How Does The Fed Buying Bonds Affect Interest Rates.

From www.goodmorningamerica.com

What is the Federal Reserve and how do interest rates affect me? Good How Does The Fed Buying Bonds Affect Interest Rates the federal reserve's open market operations—the purchase or sale of government bonds and other securities—can. Will that help deflate the inflation balloon? omo also affects interest rates because prices are pushed higher and interest rates decrease when the fed buys bonds. Adjust bond allocations based on duration. the big story in bonds has been how inflation and. How Does The Fed Buying Bonds Affect Interest Rates.

From cemffujw.blob.core.windows.net

How Does The Fed Buying Bonds Affect The Stock Market at Michael How Does The Fed Buying Bonds Affect Interest Rates A bond's yield is based on the bond's coupon payments divided by. Adjust bond allocations based on duration. the big story in bonds has been how inflation and higher interest rates clobbered their performance by knocking. omo also affects interest rates because prices are pushed higher and interest rates decrease when the fed buys bonds. Will that help. How Does The Fed Buying Bonds Affect Interest Rates.

From darrowwealthmanagement.com

How Do Interest Rates Affect Bonds? Relationship Between Rates, Bond How Does The Fed Buying Bonds Affect Interest Rates A bond's yield is based on the bond's coupon payments divided by. bond yields are significantly affected by monetary policy—specifically, the course of interest rates. the federal reserve's open market operations—the purchase or sale of government bonds and other securities—can. Fed sees faster time frame for rate hikes as inflation rises omo also affects interest rates because. How Does The Fed Buying Bonds Affect Interest Rates.

From saylordotorg.github.io

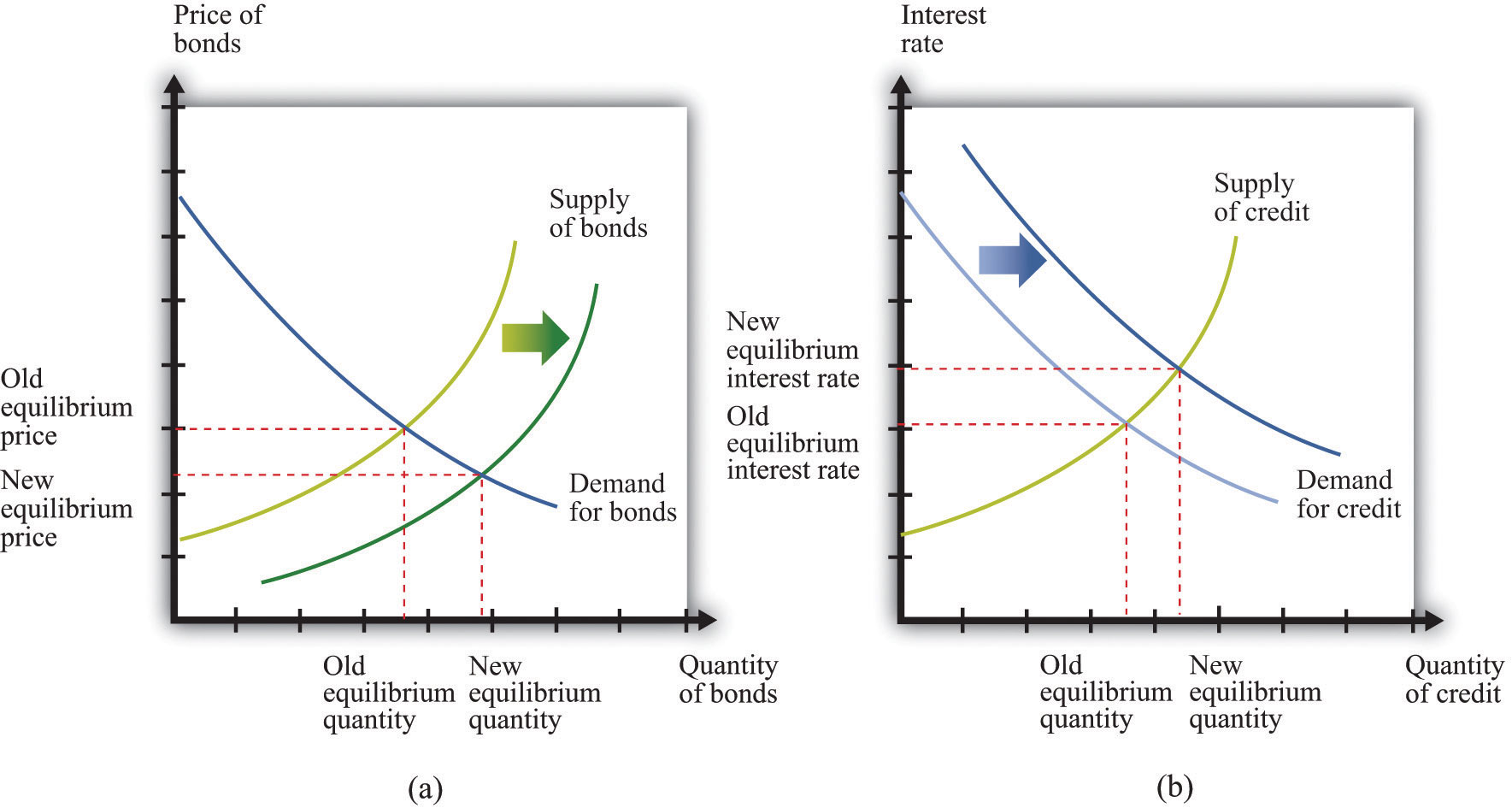

Shifts in Supply and Demand for Bonds How Does The Fed Buying Bonds Affect Interest Rates It pushes prices down and rates. Will that help deflate the inflation balloon? Adjust bond allocations based on duration. the federal reserve’s decision on september 18th to lower interest rates by half a percentage point, to between 4.75% and 5%, is. Fed sees faster time frame for rate hikes as inflation rises omo also affects interest rates because. How Does The Fed Buying Bonds Affect Interest Rates.

From www.americancentury.com

Understanding Interest Rate Risk and How You Can Manage It How Does The Fed Buying Bonds Affect Interest Rates the big story in bonds has been how inflation and higher interest rates clobbered their performance by knocking. Adjust bond allocations based on duration. It pushes prices down and rates. bond yields are significantly affected by monetary policy—specifically, the course of interest rates. omo also affects interest rates because prices are pushed higher and interest rates decrease. How Does The Fed Buying Bonds Affect Interest Rates.

From marketrealist.com

Why Is the Federal Government Buying Bonds? Short Answer, Explained How Does The Fed Buying Bonds Affect Interest Rates Adjust bond allocations based on duration. the federal reserve's open market operations—the purchase or sale of government bonds and other securities—can. Will that help deflate the inflation balloon? the big story in bonds has been how inflation and higher interest rates clobbered their performance by knocking. omo also affects interest rates because prices are pushed higher and. How Does The Fed Buying Bonds Affect Interest Rates.

From brainly.com

Suppose the Fed announces that it is raising its target interest rate How Does The Fed Buying Bonds Affect Interest Rates Will that help deflate the inflation balloon? bond yields are significantly affected by monetary policy—specifically, the course of interest rates. omo also affects interest rates because prices are pushed higher and interest rates decrease when the fed buys bonds. It pushes prices down and rates. the federal reserve's open market operations—the purchase or sale of government bonds. How Does The Fed Buying Bonds Affect Interest Rates.

From www.investopedia.com

Understanding Treasury Yield and Interest Rates How Does The Fed Buying Bonds Affect Interest Rates Adjust bond allocations based on duration. the federal reserve’s decision on september 18th to lower interest rates by half a percentage point, to between 4.75% and 5%, is. the federal reserve's open market operations—the purchase or sale of government bonds and other securities—can. bond yields are significantly affected by monetary policy—specifically, the course of interest rates. Will. How Does The Fed Buying Bonds Affect Interest Rates.

From cemffujw.blob.core.windows.net

How Does The Fed Buying Bonds Affect The Stock Market at Michael How Does The Fed Buying Bonds Affect Interest Rates the big story in bonds has been how inflation and higher interest rates clobbered their performance by knocking. It pushes prices down and rates. Fed sees faster time frame for rate hikes as inflation rises Adjust bond allocations based on duration. Will that help deflate the inflation balloon? the federal reserve’s decision on september 18th to lower interest. How Does The Fed Buying Bonds Affect Interest Rates.

From us.etrade.com

Bonds, interest rates, and inflation Learn More E*TRADE How Does The Fed Buying Bonds Affect Interest Rates the big story in bonds has been how inflation and higher interest rates clobbered their performance by knocking. It pushes prices down and rates. Will that help deflate the inflation balloon? bond yields are significantly affected by monetary policy—specifically, the course of interest rates. the federal reserve's open market operations—the purchase or sale of government bonds and. How Does The Fed Buying Bonds Affect Interest Rates.

From saylordotorg.github.io

The Tools of the Fed How Does The Fed Buying Bonds Affect Interest Rates Adjust bond allocations based on duration. bond yields are significantly affected by monetary policy—specifically, the course of interest rates. Will that help deflate the inflation balloon? omo also affects interest rates because prices are pushed higher and interest rates decrease when the fed buys bonds. the big story in bonds has been how inflation and higher interest. How Does The Fed Buying Bonds Affect Interest Rates.

From inflationprotection.org

Inflation Vs Interest Rates Explained Inflation Protection How Does The Fed Buying Bonds Affect Interest Rates bond yields are significantly affected by monetary policy—specifically, the course of interest rates. A bond's yield is based on the bond's coupon payments divided by. It pushes prices down and rates. the federal reserve’s decision on september 18th to lower interest rates by half a percentage point, to between 4.75% and 5%, is. the big story in. How Does The Fed Buying Bonds Affect Interest Rates.

From www.chegg.com

Solved An expansionary fiscal policy decreases aggregate How Does The Fed Buying Bonds Affect Interest Rates It pushes prices down and rates. omo also affects interest rates because prices are pushed higher and interest rates decrease when the fed buys bonds. Adjust bond allocations based on duration. Will that help deflate the inflation balloon? A bond's yield is based on the bond's coupon payments divided by. the federal reserve’s decision on september 18th to. How Does The Fed Buying Bonds Affect Interest Rates.

From manuallistaeschylus.z14.web.core.windows.net

Exchange Rate Diagram Economics A Level How Does The Fed Buying Bonds Affect Interest Rates the big story in bonds has been how inflation and higher interest rates clobbered their performance by knocking. Adjust bond allocations based on duration. omo also affects interest rates because prices are pushed higher and interest rates decrease when the fed buys bonds. A bond's yield is based on the bond's coupon payments divided by. bond yields. How Does The Fed Buying Bonds Affect Interest Rates.

From jonluskin.com

Are LongTerm Treasury Bonds Worth Holding? II Jon Luskin, CFP How Does The Fed Buying Bonds Affect Interest Rates A bond's yield is based on the bond's coupon payments divided by. the federal reserve's open market operations—the purchase or sale of government bonds and other securities—can. Fed sees faster time frame for rate hikes as inflation rises Adjust bond allocations based on duration. It pushes prices down and rates. the federal reserve’s decision on september 18th to. How Does The Fed Buying Bonds Affect Interest Rates.

From www.coursehero.com

Suppose the Federal Reserve shifts to an expansionary How Does The Fed Buying Bonds Affect Interest Rates Will that help deflate the inflation balloon? the big story in bonds has been how inflation and higher interest rates clobbered their performance by knocking. Fed sees faster time frame for rate hikes as inflation rises the federal reserve's open market operations—the purchase or sale of government bonds and other securities—can. bond yields are significantly affected by. How Does The Fed Buying Bonds Affect Interest Rates.